Completing Payroll Reports

How do I calculate payroll premium and complete my payroll report?

My policy is on stipulated billing. Will I still need to complete payroll reports?

What is a Split Payroll Report?

How do I calculate overtime on my payroll report?

I am completing my payroll report, but need an additional classification. What do I do?

How do I report covered officers?

I’ve lost or misplaced my payroll report. How can I obtain another one?

I made a mistake on my payroll report. How do I correct it?

Do I need to send in a payroll report if I have no payroll?

Should I keep a photocopy of my payroll report for my own records?

Submitting Payroll Reports

How do I submit my payroll report?

Do I sign all the pages of my payroll report?

Where do I send my payroll report if my policy is in jeopardy of being canceled soon?

How can I verify State Fund received and posted my payroll report?

Completing Payroll Reports

How do I calculate payroll premium and complete my payroll report?

If you are on stipulated billing, you do not need to calculate payroll premium. You do need to complete a payroll report.

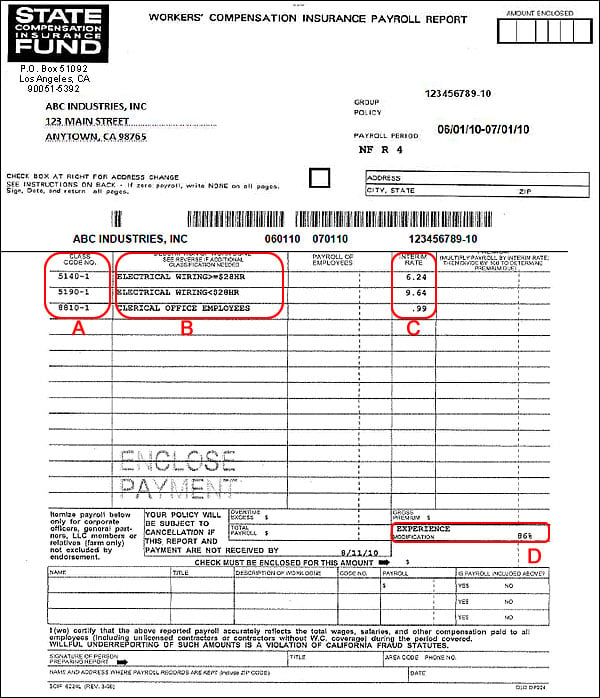

If your policy is not yet on a stipulated billing cycle, this is typically what you will see when we send you a payroll report.

-

- Class Codes are the numeric coding systems to assign job duties.

- A description of work performed spells out what the class codes reference.

- Interim rate is amount that you are being charged per one hundred dollars, including discounts (if applicable). We determine the interim rate on your payroll reports by multiplying the base rate by any discounts (such as group, merit rating and premium discount factor) for which you are qualified.

- An experience modification (ex-mod) is a premium modifier calculated by the Workers' Compensation Insurance Rating Bureau. Experience rating allows an employer’s premium to reflect their own loss experience (frequency and severity of injured workers’ claims) compared to the average loss experience of other California employers in the same industry. There are a number of variables that influence whether an ex-mod is higher or lower than the average (100%). For more information, please visit the WCIRB website.

Calculating payroll

To calculate payroll:

- First enter your total gross payroll (total employee wages before taxes and other deductions) for the reporting period in the third column, on the line for the appropriate class code.

- To calculate the premium due, multiply the total gross payroll [A] by the interim rate listed in the 4th column, then divide by 100 and enter on the appropriate line in the PREMIUM column.

- Add the figures in the PREMIUM column [B] to find your gross premium.

- Finally, multiply the gross premium by your Experience Modification (Ex-Mod) percentage to determine the total premium due.

- State Fund must receive your payroll report and payment by the date shown.

- If you do not have any payroll for the reporting period it is crucial that you complete the report by writing the word “None” on EACH page of the report, sign, date and return to State Fund in the envelope provided.

- Please be sure to sign and date ALL pages of the report at the bottom.

- There is no need to include your payroll records (we will request them at the end of the year audit, if needed).

My policy is on stipulated billing. Will I still need to complete payroll reports?

If your policy is on stipulated billing, you will still need to complete semi-annual payroll reports; however you will not have to calculate premium on those reports.

What is a Split Payroll Report?

A split payroll report is sent when there is an Anniversary Rating Date on your policy that falls after the month and day that rates, rating plans and rating systems are initially applied to a policy. Your payroll will need to be annotated for each period specified.

How do I calculate overtime on my payroll report?

Example:

Total Hours = 40

Overtime Hours = 8

Rate of Pay = $16.00

Overtime Rate = $16.00 x 1 ½ = $24.00 per hour

40 regular hours worked x $16.00 per hour = $640.00

+ 8 overtime hours worked x $24.00 per hour = $192.00

Total Payroll (640.00 + $192.00) = $832.00 total payroll

For overtime work, premium is not paid on the portion that is in excess of the regular wage rate. For “time and a half” rates, as in this example, to easily figure out the overtime excess portion take the total overtime portion of $192.00 and divide by 3. This is the exempt amount. Deduct the exempt amount from the total payroll to obtain the amount for which premium will be charged.

Example: $192.00 ÷ 3 = $64.00 overtime excess

$832.00 total payroll minus $64.00 overtime excess = $768.00 on which premium is charge.

I am completing my payroll report, but need an additional classification. What do I do?

Contact State Fund at (888) 782-8338. Please provide a complete employee job description and the classification can be added to the policy. Please do not report payroll in the new classification until it has been reviewed and endorsed to your policy.

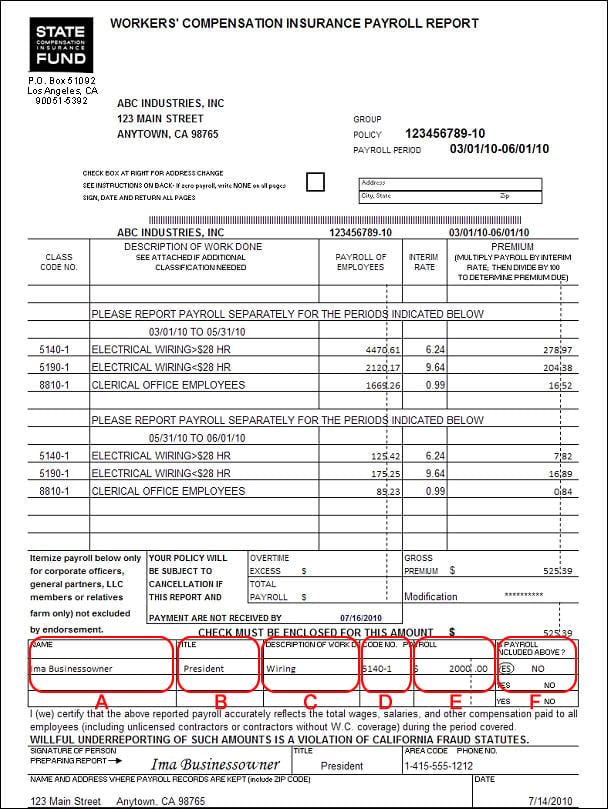

How do I report covered officers?

Officers and partners are covered for benefits unless specifically excluded by endorsement. When business partners, executive officers or directors are covered under the policy, coverage will be written at the governing or higher-rated classification applicable to the specific job duties of the supervised employees. Partners and corporate officers are subject to minimum/maximum wage limitations per the Workers’ Compensation Insurance Rating Bureau (WCIRB). Directors are subject to actual remuneration.

Report payroll for each covered officer or partner, subject to “minimum and maximum remuneration” per year, which is the lowest and highest payroll amount used to calculate premium for officer coverage. The California Workers’ Compensation Insurance Rating Bureau (WCIRB) establishes annual minimum and maximum amounts for insurance carriers to apply for covered officers. For policies initiating or renewing in 2019, the minimum is $52,000 and maximum is $133,900. This means that if an officer earned $40,000 for the 2019 policy year, the premium would be based on $52,000. Likewise, if an officer earns $140,000 for the 2019 policy year, the premium for that officer’s coverage would be based on $133,900. Premium is based on actual wages for earnings falling between the minimum and maximum amounts. Please note, for policies initiating or renewing in the 2020 policy year, the minimum is $54,600 and maximum is $139,100.

-

- The name of the officer/partner.

- The title of the officer/partner.

- A description of their job duties.

- Their class code.

- Total gross officer/partner payroll.

- Indicate “YES” or “NO” if the payroll reported in column E is also reported at the top of the report.

I’ve lost or misplaced my payroll report. How can I obtain another one?

You can call the Customer Service Center at (888) 782-8338 to request a new report. We can e-mail, fax, or mail you the new report. You can register for State Fund Online and enroll in the e-payroll and e-payment program to report your payroll and submit the payment online. However, you will not be able to print out a duplicate report.

I made a mistake on my payroll report. How do I correct it?

If you made a mistake filling it out online, call (888) 782-8338, by 1:00 p.m. on the same business day, and our Customer Service Center can make the correction. If you have a paper copy of the already-submitted report, you can make the corrections on the copy, re-sign, re-date, and write "Revised" on the report, before re-submitting with the changes. By re-signing, adding the new date and writing “Revised on the report, we can verify when the changes were made.

If you do not have a copy of the previously-submitted report, contact the Customer Service Center at (888) 782-8338. We can mail, fax, or email the report to you. Once you make all the corrections, re-sign, re-date, and write “Revised”, then fax the report to (800) 268-3635, or mail it to:

State Compensation Insurance Fund

P.O. Box 51092

Los Angeles, CA 90051-5392

Do I need to send in a payroll report if I have no payroll?

Yes, simply write “none” on each page, sign and date the report, then mail the report to notify us that you had no payroll. If you login to your policy in State Fund Online, you may report payroll and make a payment.

Should I keep a photocopy of my payroll report for my own records?

We recommend you keep a copy of your payroll reports and payroll records for at least seven years, as you would your tax records.

Submitting Payroll Reports

How do I submit my payroll report?

There are three different ways to submit your payroll reports.

- Submit payroll electronically by enrolling in State Fund Online. State Fund Online has many benefits including allowing you to report all of your payroll and pay premium electronically. Visit State Fund Online or call (888) 782-8338.

- You can also report your payroll online by clicking on the Make a Payment/Report Payroll link on the home page of this website.

- The third alternative is to mail your payroll report and payment in the envelope enclosed with the report form. If you have misplaced the envelope, please mail your payroll report to:

State Compensation Insurance Fund

P.O. Box 51092

Los Angeles, CA 90051-5392

Do I sign all the pages of my payroll report?

Yes, to certify that each page of your report is accurate; all pages need to be signed, dated, and submitted, even if you report no payroll.

Where do I send my payroll report if my policy is in jeopardy of being canceled soon?

To avoid cancellation of your policy, do one of the following:

- Login to your account at statefundca.com to report payroll and make a payment.

- Without logging in, you can submit your outstanding payroll report(s) and pay premium by clicking on the Make a Payment link on the home page of this website.

- You may also contact us at (888) 782-8338 to report your payroll and make a payment using your VISA, MasterCard, or American Express card.

How can I verify State Fund received and posted my payroll report?

You can easily check your policy by logging in at statefundca.com to verify your payroll report and payment were received. You may also register for e-payroll and e-payment, which allows you to report your payroll online and pay your premium directly from your bank account. For more information on State Fund Online benefits, or to register, visit Benefits of State Fund Online or call (888) 782-8338.